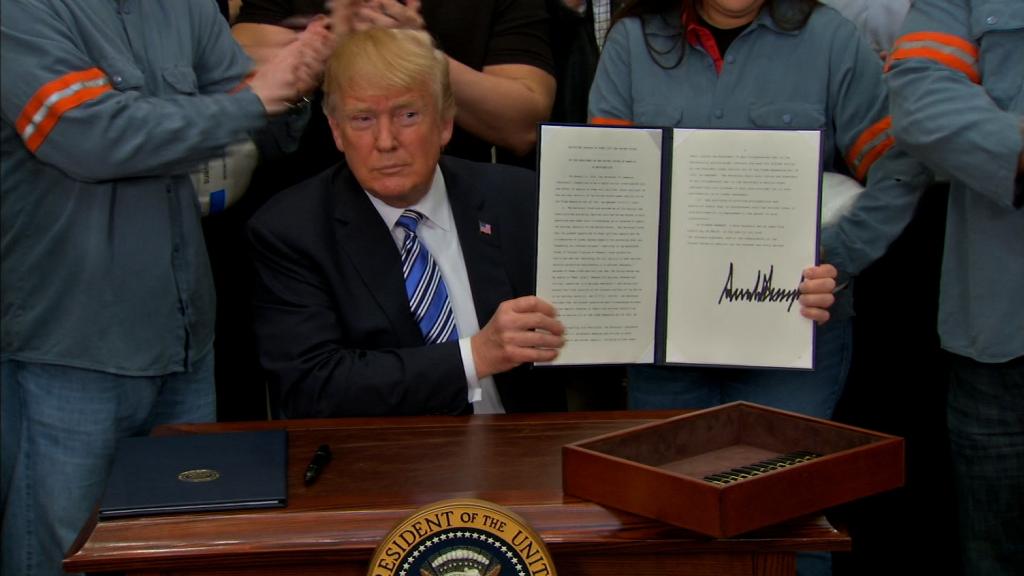

Listen up, folks! We’re diving into the big leagues of global trade here. When President Trump announced a 25% tariff on metals, it sent shockwaves across industries and nations alike. This wasn’t just some random decision; it was a bold move designed to protect American jobs and industries. But let’s break it down—what exactly does this mean for the economy, businesses, and consumers? Let’s dig in and find out!

Think about it like this: metals are the backbone of so many industries—construction, automotive, manufacturing, you name it. So, when the U.S. government slaps a 25% tax on imported steel and aluminum, it’s not just business as usual. It’s a game-changer. And guess what? The impact isn’t limited to the U.S. alone. This decision has global consequences that ripple through trade relationships, alliances, and market stability.

Now, before we jump into the nitty-gritty, let’s set the stage. This tariff was implemented in 2018, and since then, it’s been a hot topic of debate among economists, politicians, and industry leaders. Was it the right call? Did it achieve its intended goals? Or did it create more problems than solutions? Let’s find out as we explore this complex issue in detail.

Read also:Joely Richardson Reflects On Her Sister Natasha Richardsons Lasting Presence

Table of Contents

- Background on Trump's Metal Tariff

- Impact on the U.S. Economy

- Global Reactions and Trade Wars

- Industries Affected by the Tariff

- How Consumers Are Impacted

- Long-Term Outlook and Predictions

- Alternative Solutions to Tariffs

- U.S. Trade Policy Under Trump

- Political Implications of the Tariff

- Conclusion: Where Do We Go From Here?

Background on Trump's Metal Tariff

Back in March 2018, President Donald Trump made headlines when he announced a 25% tariff on imported steel and a 10% tariff on aluminum. The move was part of his “America First” trade policy, aimed at protecting domestic industries from what he called “unfair competition” from foreign producers. But why metals, you ask? Well, metals are critical to national security and economic stability, and the U.S. government wanted to ensure that domestic producers weren’t being undercut by cheaper imports.

Here’s the kicker: this wasn’t just a random decision. It was backed by Section 232 of the Trade Expansion Act of 1962, which allows the president to impose tariffs on imports that threaten national security. In this case, the argument was that reliance on foreign metals could weaken the U.S. defense industry and infrastructure. Makes sense, right? Or does it?

Why Metals Were Targeted

Steel and aluminum are essential for building everything from cars to skyscrapers to military equipment. But over the years, the U.S. has faced stiff competition from countries like China, which produces massive amounts of these metals at lower costs. This has led to a decline in domestic production and job losses in the U.S. steel and aluminum sectors. So, the tariffs were seen as a way to level the playing field and revitalize American manufacturing.

Impact on the U.S. Economy

Now, let’s talk about the impact on the U.S. economy. On one hand, the tariffs did boost domestic production of steel and aluminum. Companies like U.S. Steel and Alcoa saw increased profits as demand for American-made metals rose. Jobs were created, and workers in these industries breathed a sigh of relief. But here’s the thing—every action has a reaction, and the tariffs didn’t come without costs.

Positive Effects

- Increased production in domestic steel and aluminum industries.

- Creation of jobs in manufacturing and related sectors.

- Strengthening of national security by reducing reliance on foreign metals.

Negative Effects - Rising costs for businesses that rely on imported metals.

- Higher prices for consumers who buy products made with steel and aluminum.

- Retaliation from trade partners, leading to further economic disruptions.

Global Reactions and Trade Wars

When the U.S. announced the tariffs, the global community didn’t exactly roll out the red carpet. Countries like Canada, Mexico, and the European Union were hit hard because they are major exporters of steel and aluminum to the U.S. In response, they slapped their own tariffs on American goods, sparking a trade war that threatened to derail global economic growth.

Take Canada, for example. They retaliated by imposing tariffs on U.S. products like whiskey, maple syrup, and steel. Meanwhile, the EU targeted iconic American goods like Harley-Davidson motorcycles and Levi’s jeans. It was a tit-for-tat battle that escalated quickly, leaving businesses and consumers caught in the crossfire.

Read also:Eva Longoria Opens Up About Her Pregnancy Journey

Trade Wars: Winners and Losers

Trade wars aren’t all bad news for everyone. Some countries, like Brazil and South Korea, actually benefited from the tariffs. They negotiated exemptions or quotas, allowing them to continue exporting metals to the U.S. without facing the full brunt of the tariffs. But for others, the impact was devastating. Jobs were lost, industries suffered, and diplomatic relations were strained.

Industries Affected by the Tariff

Let’s zoom in on the industries that felt the pinch of the tariffs. Construction, automotive, and manufacturing were among the hardest hit. These sectors rely heavily on steel and aluminum, and the increased costs of these materials translated into higher prices for consumers. For example, the cost of building materials like rebar and steel beams skyrocketed, making construction projects more expensive.

The automotive industry wasn’t spared either. Car manufacturers faced higher costs for producing vehicles, which they passed on to consumers in the form of higher prices. And don’t forget about the beverage industry, where aluminum cans became more expensive to produce. It’s a domino effect that touches almost every corner of the economy.

Construction Industry

For the construction industry, the tariffs meant higher costs for materials and longer project timelines. Builders had to find ways to absorb the increased expenses or pass them on to clients, which wasn’t always an option. In some cases, projects were delayed or canceled altogether, leading to job losses and reduced economic activity.

How Consumers Are Impacted

Now, let’s talk about the elephant in the room—consumers. When businesses face higher costs, guess who ultimately pays the price? That’s right, us—the everyday folks buying cars, homes, and appliances. The tariffs led to higher prices for goods made with steel and aluminum, from refrigerators to cars to beer cans. It’s a classic case of trickle-down economics, but in reverse.

But it’s not all doom and gloom. Some consumers benefited from the tariffs indirectly. For example, workers in the steel and aluminum industries saw their incomes rise as demand for American-made metals increased. And for those who value supporting domestic industries, the tariffs were a step in the right direction.

Examples of Price Increases

- Cars: Higher costs for steel led to increased prices for new vehicles.

- Appliances: Refrigerators, washing machines, and other appliances became more expensive due to aluminum tariffs.

- Construction: Homebuyers faced higher costs for new builds and renovations.

Long-Term Outlook and Predictions

So, where do we go from here? The long-term impact of the tariffs depends on a variety of factors, including global trade dynamics, domestic production levels, and economic growth. Some experts predict that the tariffs will lead to a stronger domestic metals industry in the long run, while others warn of lasting damage to trade relationships and global markets.

One thing is for sure: the world of global trade will never be the same after the Trump administration’s tariffs. Whether you view them as a necessary measure to protect American jobs or as a reckless gamble with the global economy, one thing is clear—they’ve changed the game forever.

Predictions for the Future

- Continued growth in domestic steel and aluminum production.

- Persistent trade tensions with key partners like Canada and the EU.

- Increased focus on alternative materials and technologies to reduce reliance on metals.

Alternative Solutions to Tariffs

Of course, tariffs aren’t the only way to address trade imbalances and protect domestic industries. Other solutions, like investing in research and development, improving infrastructure, and negotiating better trade agreements, could also help level the playing field. The key is finding a balance between protecting American jobs and maintaining strong trade relationships with allies.

For example, investing in automation and technology could help U.S. manufacturers compete with lower-cost producers abroad. Or, negotiating trade deals that address unfair practices like subsidies and dumping could help level the playing field without resorting to tariffs. It’s all about finding the right approach for the situation.

U.S. Trade Policy Under Trump

The metal tariffs were just one part of a larger trade policy under the Trump administration. From renegotiating NAFTA to imposing tariffs on Chinese goods, the administration took a hardline stance on global trade. The goal was to reduce trade deficits, protect American jobs, and ensure fair competition. But as we’ve seen, these policies often came with unintended consequences.

One of the biggest challenges was balancing the needs of different industries and constituencies. While some sectors benefited from the tariffs, others suffered. And the global community wasn’t exactly thrilled with the U.S. taking a unilateral approach to trade. It’s a delicate balancing act that requires careful consideration of both domestic and international interests.

Political Implications of the Tariff

Finally, let’s talk about the political implications of the tariffs. They became a key issue in the 2020 presidential election, with both sides weighing in on their effectiveness. Supporters praised them as a bold move to protect American jobs and industries, while critics argued they hurt consumers and strained diplomatic relations.

As the U.S. continues to navigate the complexities of global trade, the legacy of the metal tariffs will be felt for years to come. Whether future administrations choose to continue or reverse these policies remains to be seen, but one thing is certain—they’ve left an indelible mark on the global trade landscape.

Conclusion: Where Do We Go From Here?

Alright, let’s wrap this up. Trump’s 25% tariff on metals was a bold move with far-reaching consequences. It protected domestic industries and created jobs, but it also led to higher prices for consumers and strained trade relationships. In the end, the impact of the tariffs depends on how you look at it—glass half full or half empty?

As we move forward, it’s important to consider all sides of the issue and find solutions that work for everyone. Whether through tariffs, negotiations, or investments in technology, the goal should always be to create a fair and sustainable global trade system that benefits all participants.

So, what do you think? Leave a comment below and let us know your thoughts on the metal tariffs. And if you enjoyed this article, be sure to share it with your friends and check out our other content on global trade and economics. Stay informed, stay engaged, and let’s keep the conversation going!